Should you be self-utilized or have a small business enterprise, the rules also are unique, so you should definitely consult with IRS laws using your distinct scenario in your mind.

Finally, you could immediate Equity Trust to fund your precious metals investment through the vendor of the selection when you have a offer that is sensible.

Alto causes it to be much easier to take a position in alternative assets by partnering with prime investment platforms as an alternative to attempting to build every little thing on their own.

When you are on a Galaxy Fold, take into account unfolding your telephone or viewing it in complete screen to most effective optimize your working experience.

Two main forms of IRAs are the standard IRA and also the Roth IRA. Equally is usually useful accounts, but they have somewhat distinctive tax advantages. A couple extra sorts of IRAs exist in addition.

Understand our editorial insurance policies Our editorial crew works by using a strict editorial critique process to compile all assessments, analysis, and evaluations of any form. Our enterprise, WallStreetZen Limited, is supported by our user community and will receive a smaller commission when purchases are created as a result of husband or wife one-way links. Commissions will not have an affect on the thoughts or evaluations of our editorial group.

The amount am i able to withdraw from my IRA devoid of paying taxes? You will pay revenue taxes out of your classic IRA withdrawals visit site irrespective of your age. For those who’re under age fifty nine½ you’ll also incur a 10% penalty for withdrawals that don’t fit permitted rules in the IRS.

When we surveyed the field to uncover the most beneficial robo-advisors, a few platforms Evidently led the sphere. Betterment was one of them, because of its competitive annual management charge and The shortage of any minimum amount harmony requirement, to help you arrange your Roth IRA account it doesn't matter in which you’re at with retirement planning.

But if you don’t have any knowledge or expertise buying housing, copyright, or other assets, you might want to learn more before opening an SDIRA.

Backdoor Roth IRA What it really is and the way to set it up If you're a higher-income earner, a Backdoor Roth IRA may be a superior retirement investment choice for you. Discover what it really is and how to create this sort of retirement plan.

Due to SDIRA’s distinctive guidelines, beginner buyers can leave on their own subjected to tax surprises, fraud and a number of other drawbacks, probably creating far more head aches than Added benefits.

You can utilize the SDIRA by alone and Allow Entrust Team manage all your investments, but you can also build an LLC and have checkbook Management if you want far more control. Over-all, the System offers wonderful overall flexibility and wonderful check this site out assistance. Charges & Commissions

Entrust can assist you in getting alternative investments with your retirement resources, and administer the buying and offering of assets that are typically unavailable by means of financial institutions and brokerage firms.

Rollover IRA: A rollover IRA is practically nothing in excess of a standard IRA that receives resources an investor has transferred more than from a workplace retirement plan, similar to a 401(k). When you’re shifting Employment, approaching retirement or turning into self-used, you might look into a rollover IRA.

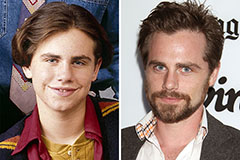

Rider Strong Then & Now!

Rider Strong Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Julia Stiles Then & Now!

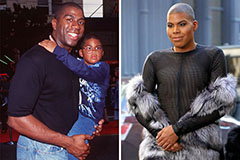

Julia Stiles Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!